Free Paycheck Calculator: Hourly & Salary Take Home After Taxes

Table of Content

However, depending on the severity of the financial situation, a case could be made for at least contributing as much as possible towards what an employer will match for a 401. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Social Security taxes will take 6.2% of up to $118,500 of your salary, and Medicare taxes will take another 1.45%, and is applied to your entire salary, no matter how much it is. Each province or territory is responsible for setting its own.

Benefits such as conveyance allowance, medical allowance, and housing rent allowance are included in an employee's gross income. It is a fixed salary component that typically accounts for 40% to 50% of the total CTC. Many additional CTC components, such as provident fund contribution, gratuity, and others, are based on the basic pay. This is the total before any deductions, increments, bonuses, or allowances are applied. In contrast to other parts of the CTC, the base wage would stay unchanged. When you're done, click on the "Calculate!" button, and the table on the right will display the information you requested from the tax calculator.

Why calculate my net salary?

From 6th November 2022, the standard rate of NI will return to 12% and on earnings over the upper threshold will return to 2%. You might agree with your employer to contractually reduce your salary by a certain amount, in exchange for some non-cash benefits. From April 2017, most schemes will only save National Insurance on the value of those benefits. If you do not know the percentage that you contribute, you can instead choose to enter the amount, in pounds and pence, that you contribute from each payslip. Unfortunately, we are currently unable to find savings account that fit your criteria. In general, it is wise to stop contributing towards retirement when facing immediate financial difficulty.

We haveto add some capital amortisation to each monthly sum, while still payinginterest on the amount of the outstanding loan. NPER calculates the number of payment periods for an investment based on regular, constant payments and a constant interest rate.PV returns the present value of an investment. The present value is the total amount that a series of future payments is worth now.

How Do I Figure Out How Much Interest I Will Pay On A Loan

Your CTC is frequently used to determine annual appraisals and raises. The components of CTC, on the other hand, differ from one employer to the next. Government employers, for example, may have a different CTC structure than private-sector businesses. Employees in the government sector are frequently paid in grade pay. The cost to the business, or CTC, is the cost a company incurs when recruiting a new employee.

In order to find out what your monthly payments might be, you can use a mortgage formula or a calculator. This will give you a good estimation of whether you can afford the mortgage. Home loans are amortized over 30 years with monthly payments that are the same each month. As you begin to pay your mortgage, you will actually pay more in interest. Over time, as the loan decreases, more of your money goes toward the principal. You can figure out your take-home salary in just a few clicks using our Canadian salary calculator.

How To Ask For A Mortgage Loan

However, this only applies to people working in industries that are federally regulated, such as postal services, interprovincial transportation, or banks. Outside of these jobs, the minimum wage is set by the province or territory in which a worker is employed. Provincial tax, which is the money you're paying to the provincial government. The rate varies based on the province in which the income was generated.

Canada Pension Plan or Quebec Pension Plan contributions, which act as a financial security blanket if you lose income due to disability, death, or retirement. These contributions and employer matches are made automatically each time you're paid. The highest amount payable under this direct tax to the state government each year is ₹2,500. There are multiple factors that are incorporated into a salary. It is highly recommended by experts from Vakilsearch to use the salary calculator for easy calibration.

Understanding the different components ofsalary

Each fiscal year, the taxpayers must present Form 16 in filing their income taxes, and this document serves as evidence of his\her earnings and tax payments to the govt. The total of your monthly debt payments divided by your gross monthly income, which is shown as a percentage. Your DTI is one way lenders measure your ability to manage monthly payments and repay the money you plan to borrow.

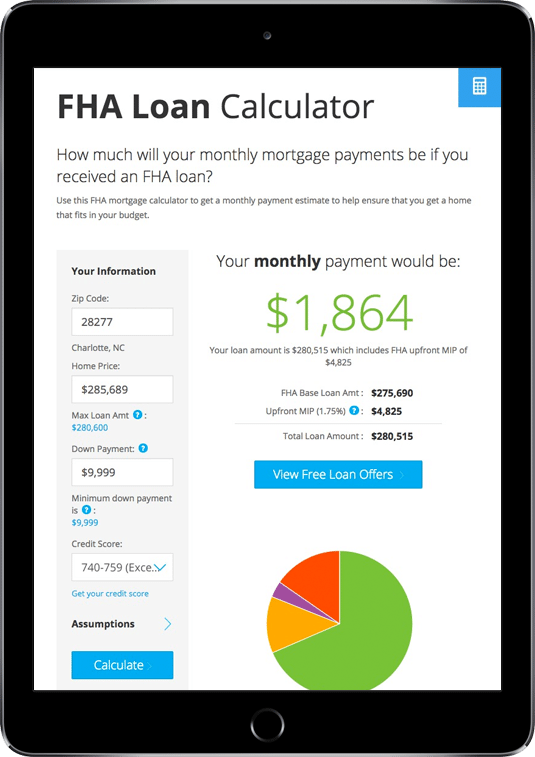

With a FHA loan, your debt-to-income limits are typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances. When owning a home, you pay annual property taxes based on the assessed value of the property or purchase price of the home, which can affect your affordability.

The national average salary in Ireland is €45,324, according to the Central Statistics Office . If we run this through our Irish salary calculator, that's a salary after tax of €34,815 a year, €2,901 a month, and €670 a week. Come tax day, what you owe will look different once these circumstances are taken into account. For a clearer look at what most residents of these provinces make, take a look at the table below. We've compiled each province's median salary, based on data from Statistics Canadafor 2020. That means that the numbers represent Canadian salaries before taxes, contributions, and premiums have been applied.

Nowadays, employers tend to roll everything into one concept called paid time off . In some cases, unused PTO at the end of the year can be "exchanged" for their equivalent financial value. If a company does allow the conversion of unused PTO, accumulated hours and/or days can then be exchanged for a larger paycheck. Using arepayment mortgage calculator is probably the quickest way to gain an idea ofmonthly mortgage payment levels. This example of an onlinemortgage calculator will tell you how much the monthly repayments will be for agiven loan amount, term and interest rate.

For more information on the tax system in Ireland, including a breakdown of tax rates and deductions, you can visit our Tax Calculator for Irelandpage. You have a new job or got a raise and you want to know your salary net of tax? On the lower end of the spectrum, the federal minimum wage, which is the lowest amount you can legally be paid, is $15.55.

If you receive cash allowances, like a car allowance or mobile phone allowance, and this is also included in your pensionable pay, tick the "Include cash allowances" box. If you are being awarded a bonus by your employer, enter the £ value of this bonus and choose your normal pay period. If you know your tax code, enter it here to get a more accurate calculation of the tax you will pay.

For some people, although the amount they are getting paid has been reduced, their pension contributions are still calculated on their full salary. If this applies to you, tick this box and the calculator will use your full salary to work out the pension contributions to apply. From April 2017 If you live in Scotland, income tax is calculated differently than if you live in the rest of the UK. If you have a pension which is deducted automatically, enter the percentage rate at which this is deducted and choose the type of pension into which you are contributing. Pension contributions are estimates, click to learn more about pension contributions on The Salary calculator. Fisdom’s take-home salary calculator also provides the monthly take-home salary amount along with annual.

If you are unsure of your tax code, just leave it blank and the default will be applied. If you know your tax code, enter it into the tax code box for a more accurate take-home pay calculation. If you are unsure of your tax code just leave it blank and the default code will be applied.

Comments

Post a Comment